The SignalVest Playbook

A Strategic Framework for Signal Intelligence & Market Edge

Why the Playbook Exists

At SignalVest, we don’t react to noise. We decode it.

This Playbook is your guide to understanding how we analyze markets, identify high-conviction trades, and detect risk before it becomes obvious. Whether you're a discretionary trader, institutional analyst, or an investor seeking signal in a sea of sentiment, this framework reveals the “why” behind every post, chart, and red flag.

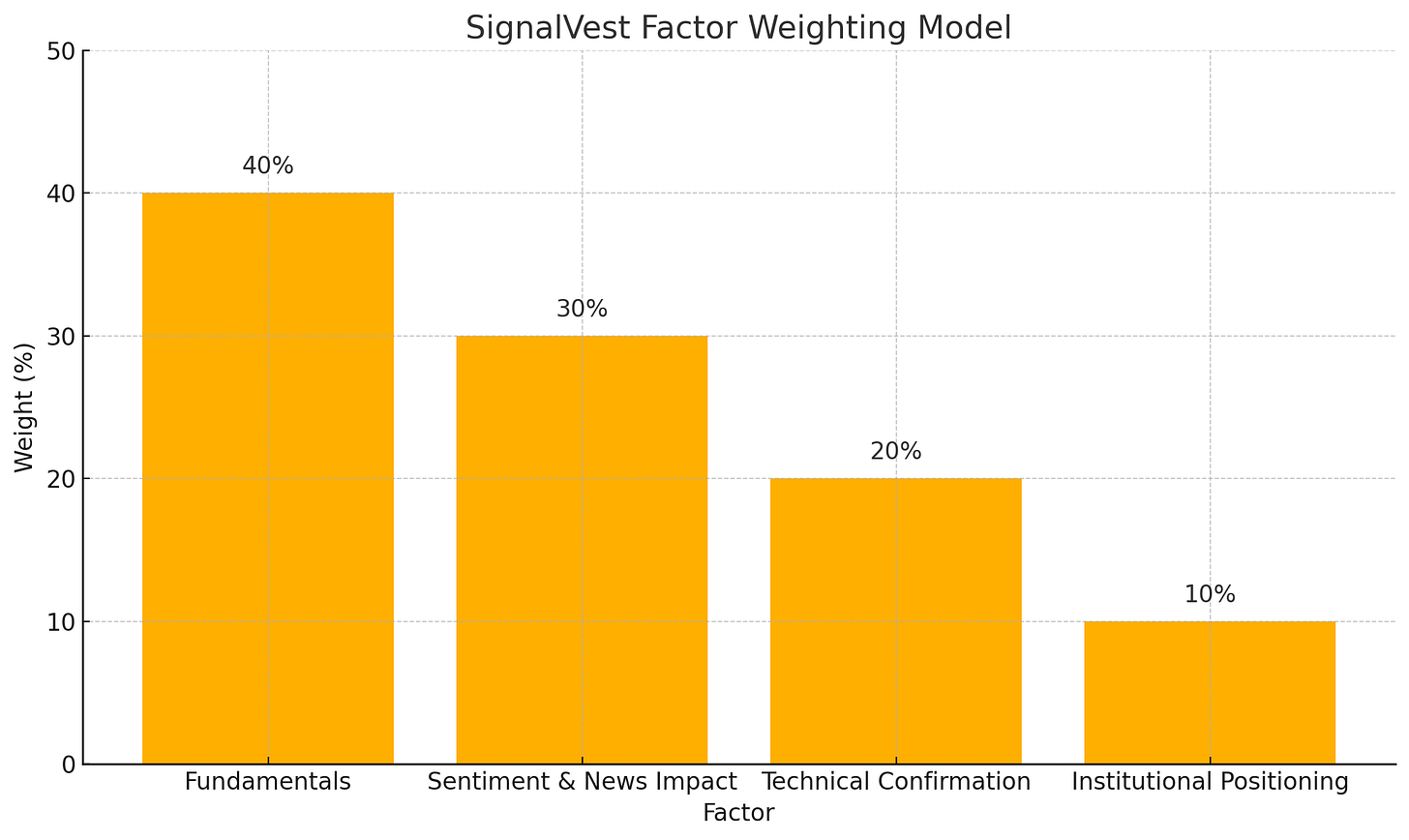

Our Core Framework: The Signal Weighting Model

Each insight you read on SignalVest is informed by a multi-factor signal intelligence model, weighted according to institutional priorities and market psychology:

These weights are fixed for now to maintain consistency, but we may introduce adaptive models based on event type or regime in the future.

What We Look For in a Trade Setup

SignalVest setups are not frequent. They are curated.

We wait for asymmetric opportunities where:

Fundamentals show divergence from price

The crowd believes a narrative that institutional flows contradict

There is a buildup of tension around a binary event (earnings, guidance, macro prints)

Insider actions, capital raises, or filings suggest a hidden motive

Red flags (e.g., serial dilution, CFO exits, cash burn) go unnoticed by retail

Each trade idea or risk warning will clearly indicate which of the four signal pillars are active — and how strongly.

What Makes a “Red Flag” Case?

A Red Flag post is issued when our forensic signal model detects:

Sudden or frequent private placements and dilution

Consistent executive stock selling

Cash burn + asset sales without growth

Accounting inconsistencies (e.g., capitalizing normal expenses)

Shifting narratives in earnings calls that signal distress or distraction

These are often early warnings — not immediate trade calls — but have proven powerful in spotting stocks before major drawdowns.

What About Charts?

We use TradingView for all charting. Each chart is:

Contextualized within the full signal model

Annotated with key levels, liquidity zones, or divergence structures

Only used when technicals confirm the fundamental or sentiment thesis

You won’t see random lines or price predictions here. Every chart must earn its place.

Who This Is For

This Playbook and the content on SignalVest are intended for:

Active investors looking for deeper context than price action

Traders seeking signal alignment before entry

Analysts who want structured frameworks to anticipate risk

Skeptics who prefer evidence over narratives

Whether you use our insights to support a trade, build your own thesis, or avoid a landmine — the Playbook gives you the lens to evaluate each SignalVest post with confidence.

Coming Soon: Tools & Downloads

We’ll soon be releasing:

A forensic red flag checklist (PDF)

An event-playback case study from past earnings

Our SignalVest Earnings Tracker template

Custom TradingView indicators aligned with the model

Subscribers will be notified when each drops.

Stay Aligned

For deeper reports and flagged setups, subscribe to our main feed.

For faster pulse updates, explore the Notes tab.

To understand how we got a call right (or wrong), revisit the Archive.

And when in doubt — return to the Playbook.